Brazil Soybeans: Record Area and Yield Push Production Higher

USDA estimates Brazil soybean production for marketing year (MY) 2025/26 at a record 180.0 million metric tons, up 1 percent from last month, 5 percent from last year and 19 percent above the 5-year average. Harvested area is estimated at a record 49.4 million hectares, up 1 percent from last month, 4 percent from last year and 12 percent above the 5-year average. Yield is estimated at a record 3.64 tons per hectare (t/ha), up 1 percent from last month and last year, and 6 percent above the 5-year average.

Prospects for Brazil’s soybean crop remain strong, as most areas enter harvest. Reports of positive crop conditions have been nearly ubiquitous, and early harvest reports indicate above-average yields in most states. Additionally, recent state-level reporting indicates higher area than previous estimates.

Approved by the World Agricultural Outlook Board

Conditions are notably improved, year-to-year, in Mato Grosso do Sul and Rio Grande do Sul, which have experienced drier conditions and lower yields in recent years. This season, however, abundant rainfall promoted strong crop vigor. Satellite-derived Percent of Average Seasonal Greenness (PASG) measurements indicated above-average crop conditions in virtually all of the major soybean-growing states through peak season. Cropping in Rio Grande do Sul lags that of the other states by several weeks, however PASG indicates strong crop health there as soybeans progress through reproduction and towards maturity

Malaysia Palm Oil: Estimated Production Increased Due to Favorable Weather

USDA estimates Malaysia marketing year (MY) 2025/26 palm oil production at 20.2 million metric tons (mmt), up 3 percent from last month, and 4 percent from last year. Harvested area is estimated at 5.6 million hectares, unchanged from both last month and last year. Yield is estimated at 3.61 metric tons per hectare, up 3 percent from last month, and 4 percent from last year.

Palm oil is a highly water intensive crop. The monthly water requirement to achieve yield potential is between 150 millimeters and 200 millimeters. Due to the characteristics of palm oil, there is a delayed physiological response to water uptake, where rainfall in one period can prompt a vegetative response in later months. This delayed period is called the time lag effect.

Since January of 2025, monthly rainfall accumulations have met or exceeded the water requirements threshold in the main palm oil producing states. As a result, monthly crude palm oil production for MY 2025/26, which begins in October 2025 and ends in September of the following year, has exceeded expectations. The latest January report from the Malaysia Palm Oil Board (covering October through December 2025) indicates crude palm oil production year-to-date at 5.81 mmt, up 18 percent from the same period last year and 19 percent from the 5-year average.

Paraguay Soybeans: Favorable Weather Boosts Yield

USDA estimates Paraguay soybean production for marketing year 2025/26 at 11.5 million metric tons, up 5 percent from last month and 13 percent from last year. Yield is estimated at 3.03 tons per hectare, up 5 percent from last month and 11 percent from last year. Harvested area is estimated at 3.8 million hectares, unchanged from last month and up 1 percent from last year.

In Paraguay, soybeans are generally planted from October through December. This year, planting occurred earlier than usual, resulting in accelerated crop development. The satellite-derived Normalized Difference Vegetation Index (NDVI) indicates crop conditions across the primary growing regions are above average and better than last year. Favorable seasonal rainfall has supported optimal crop growth, suggesting yields may exceed initial expectations.

Brazil Corn: Production Unchanged on Normal Cropping Cycle

USDA estimates Brazil corn production for marketing year (MY) 2025/26 at 131.0 million metric tons, unchanged from last month, but down 4 percent from last year’s record crop, and yet 10 percent above the 5-year average. Harvested area is estimated at a record 22.6 million hectares, unchanged from last month, but up 1 percent from last year and 5 percent above the 5-year average. Yield is estimated at 5.80 tons per hectare, unchanged from last month, but down 5 percent from last year on a return to normal weather patterns. Corn yield is estimated to be 6 percent above the 5-year average.

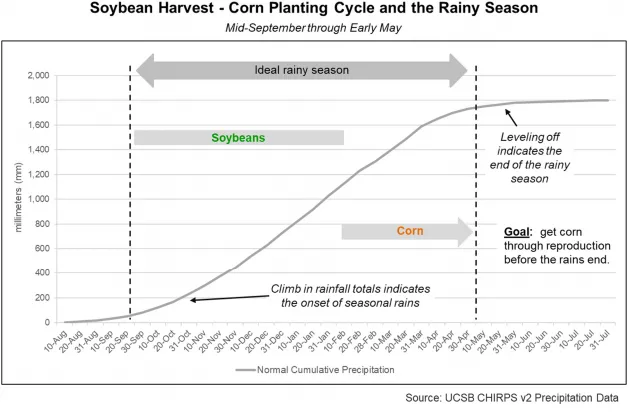

Brazil’s corn production largely reflects its safrinha crop, which represents over 75 percent of annual production. Safrinha corn is grown primarily in the Central-West states of Mato Grosso, Mato Grosso do Sul, and Goiás, and the southern state of Paraná, representing 86 percent of safrinha corn production. Planting for safrinha corn begins after soybean harvest, preferably in late-January through the middle of February. This soybean-harvest to corn-planting cycle allows for adequate exposure for the corn crop to the annual rainy season, which normally runs from mid September through the end of April.

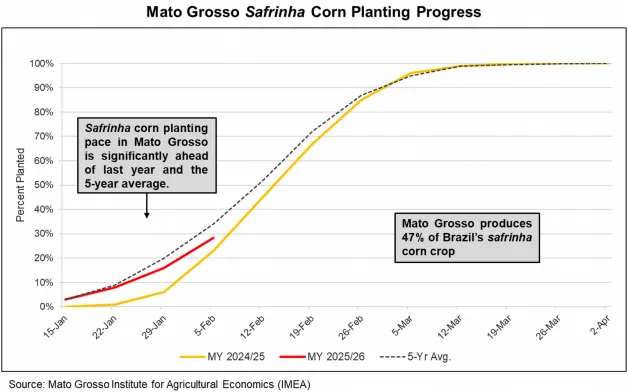

Soybean planting or harvest delays in the Central-West can delay safrinha corn planting resulting in a compressed season and potentially lower yields. In an ideal scenario, corn will have adequate time to progress through reproduction before the end of the rainy season near the beginning of May. Corn planting in Mato Grosso was substantially delayed last season, though the rainy season extended unusually through much of May, leading to a bumper crop. Corn planting in the state lags the average again this season, at 28 percent complete at the beginning of February versus 36 percent on average. For comparison, safrinha corn was only 23 percent planted at this point last season.

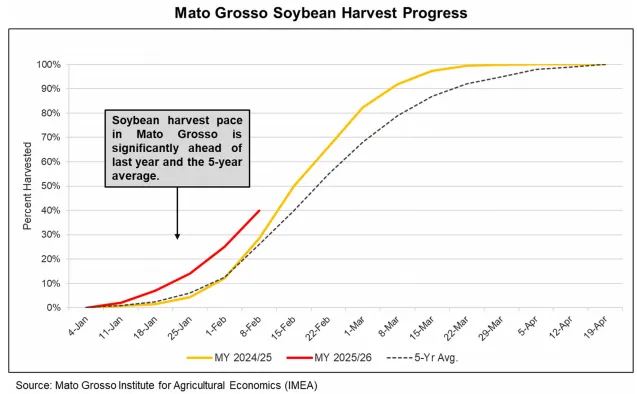

The soybean harvest pace in Mato Grosso this season has been rapid, however. According to the Mato Grosso Institute for Agricultural Economics (IMEA), the soybean harvest is 40 percent complete, well ahead of last year (29 percent) and the 5-year average (26 percent). With this harvest pace, adequate area is available for corn planting, which is expected to accelerate in the coming weeks and allow for positive crop development through the normal rainy season.

South Africa Wheat: Mid-season Dry Spells Reduce Production Prospects

USDA estimates South Africa wheat production for marketing year (MY) 2025/26 at 1.9 million metric tons, down 5 percent from last month, 2 percent from last year and 9 percent below the 5-year average. Harvested area is estimated at 517,000 hectares, up 2 percent from last year, but down 2 percent from the 5-year average. Yield is estimated at 3.68 tons per hectare, down 5 percent from last month, 4 percent from last year, and 7 percent below the 5-year average. Crop production prospects were reduced because of two consecutive mid-season dry spells in the Western Cape province.

South Africa wheat yields tend to be above average when the Western Cape receives favorable rains during the growing season from May through early September. Over 50 percent of South Africa’s rainfed wheat production is grown in Western Cape where favorable mid-season rains during July and August are critical for normal grain development and achieving average yields.

Cropland Normalized Difference Vegetation Index (NDVI) measurements from MODIS satellite imagery rapidly dropped during July and August in response to two prolonged dry spells that reduced vegetation biomass and correspondingly indicated a below-average harvest. Harvest started in late September and South Africa Grains Information Service (SAGIS) reported nearly 91 percent of the crop was harvested and delivered to silos by the end of January.

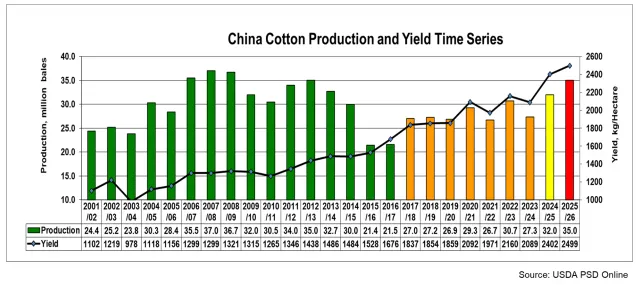

China Cotton: Production Increased Due to Record Yield

USDA estimates China marketing year (MY) 2025/26 cotton production at 35.0 million 480-pound bales, up 1 percent from last month, 9 percent from last year, and 20 percent above the 5-year average. Harvested area is estimated at 3.1 million hectares, unchanged from last month, up 5 percent from last year and 3 percent above the 5-year average. Yield is estimated at a record 2,499 kilograms per hectare, up 1 percent from last month, 4 percent from last year, and 17 percent above the 5-year average.

In recent years, yields continue to be significantly above the long-term trend due to the increasing quantity of cotton produced in Xinjiang province, where the yield has nearly doubled compared to elsewhere in the country. More than 90 percent of cotton is now produced in Xinjiang province using pest-resistant, genetically modified cotton seeds under highly mechanized farming and irrigation systems. According to Xinjiang Provincial Statistics Department, approximately 41 percent of cotton is produced by Xinjiang Production and Construction Engineering Corp, and 59 percent is produced by the Local Cooperative System.

The typical cotton growing season is April to October. In Xinjiang, planting starts in April while on the North China Plain and in the Yangtze River basin planting begins in late April and extends through May. The start-of-season satellite-based derivatives indicated favorable irrigation reservoir levels, soil moisture conditions and crop progress over the main cotton growing areas. These conditions facilitated rapid planting, early crop establishment and development. The observations were also supported by a combination of national and regional crop condition analysis inputs from FAS/Beijing. In Xinjiang, planting was completed within the optimum planting window that typically ends in May.

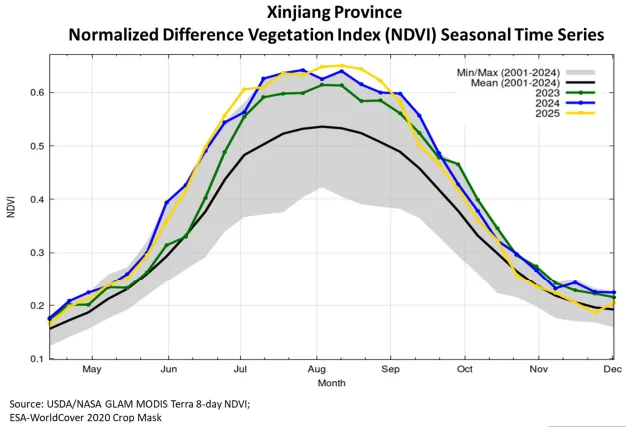

According to China Agricultural Supply and Demand Situation Analysis Report (CASDE), cotton in most areas of Xinjiang generally progressed favorably throughout the majority of the growing season ensuring higher yields than in previous years. The favorable crop growth and development was also indicated by the satellite-derived seasonal Normalized Difference Vegetation Index (NDVI). In addition to the favorable planting and crop development conditions, farmers continue to be encouraged by the government’s continuation of the target price-based cotton subsidy. The year-to-year 5 percent increase in harvested area is primarily due to marginal area expansion in the major cotton producing province of Xinjiang, while regions outside Xinjiang continued to experience larger area reductions, especially on the North China Plain and in the Yangtze River basin. The significant year-to-year yield increase, especially in Xinjiang, continues to offset planted area reductions on the North China Plain and in the Yangtze River basin, resulting in a significant increase in national cotton production.

Mexico Cotton: Production Drops Further due to Decreased Area

USDA estimates Mexico cotton production for marketing year (MY) 2025/26 at 565,000 480-pound bales, down 3 percent from last month and 43 percent from last year. Harvested area is estimated at 72,000 hectares (ha), down 4 percent from last month and 43 percent less than last year. Yield is estimated at 1,709 kilograms per hectare (kg/ha), up 1 percent from last month but down 1 percent from last year.

Farmers planted less cotton due to low international cotton prices in addition to higher input costs (averaging 25 percent above previous years), drought conditions during the two previous marketing years, limited access to improved seed varieties, and competition with textile products coming from Asia. Area estimates for Mexico cotton have not dropped below 70,000 ha since MY 2003/04.

Cotton is primarily irrigated and grown in the northern states of Mexico, with 85 percent produced in Chihuahua this year. This season, the rains had an impact on two occasions. First, since seasonal rains arrived late, farmers refrained from planting additional cotton as the season progressed. Second, rain later in the season boosted yields. Producers in key municipalities of Chihuahua – including Ascención, Janos, and Ojinaga – have reported high crop quality. Improved yields were also aided by fewer power outages supporting irrigation throughout the season.

Up until last year, Coahuila was the second-largest producing state. According to FAS/Mexico City, farmers in Coahuila are estimated to produce less than 2,000 480-pound bales this marketing year, as compared to 55,000 480-pound bales in MY 2024/25, because farmers are reserving water for walnut trees.

Ninety-seven percent of cotton production is associated with Mexico’s Spring-Summer reporting season. Almost all planting occurs in March and April, while harvest usually begins in late August through December. This year’s harvest concluded in January.